Whether you’re applying for a credit card, a loan, or a mortgage, your credit score is a key factor that lenders consider. But what exactly is a credit score, and why is it important? In this beginner’s guide, we will delve into the fundamentals of credit scores and how they impact your financial well-being. Understanding credit scores is essential for making informed financial decisions, and it plays a significant role in achieving your financial goals.

The Basics of Credit Scores

Before we dive into the details, let’s start by understanding what a credit score is and how it is calculated. A credit score is a three-digit number that represents your creditworthiness and is derived from your credit history. It provides lenders with a snapshot of your creditworthiness and helps them assess the risk of lending you money. A higher credit score indicates a lower credit risk, making you a more attractive borrower to lenders.

What Is a Credit Score?

A credit score is a numeric representation of your creditworthiness and financial history. It is based on information from your credit report, which includes details about your credit accounts, payment history, and credit inquiries. Credit scores are generated by credit bureaus, which are agencies that collect and maintain credit information on individuals and businesses. In the United States, the three major credit bureaus are Experian, Equifax, and TransUnion.

Your credit score is calculated using a scoring model, with different scoring models being used by different lenders and credit bureaus. The most common scoring model is the FICO score, which was developed by the Fair Isaac Corporation. Another scoring model is the Vantage Score, which is used by different lenders and may result in different scores compared to the FICO score. It’s important to note that each scoring model may weigh factors slightly differently, resulting in variations in credit scores.

The Importance of Credit Scores

Understanding the importance of credit scores is crucial for financial stability and growth. These scores significantly impact loan approval and interest rates, influencing the terms and rates offered. With good credit scores, individuals can access better loan terms and lower interest rates, paving the way for improved financial health. Credit scores play a pivotal role in accessing credit and loans, making it essential to maintain a positive score. Recognizing the significance of credit scores is fundamental for achieving financial goals and securing better financial terms in the United States.

Calculating Credit Scores

To calculate credit scores, various factors are considered such as credit history, debt, and payment records. Credit inquiries can also impact the score. FICO and Vantage are the main scoring models used, each with its own criteria. Understanding these different scores and their impact is essential. The length of your credit history, credit mix, and credit utilization rate also play a significant role. Recognizing these factors and how they contribute to your score is crucial for maintaining financial goals.

The Role of Credit History and Debt

Understanding the role of credit history and debt is crucial for credit management. Both significantly impact credit scores, with the length of credit history and types of credit accounts playing a key role. Effective management is essential for maintaining good credit scores, as a positive credit history and responsible debt lead to higher scores. By comprehending the impact of credit history and debt, individuals can make informed decisions and take necessary steps to improve their credit standing.

Impact of Payment Records

Payment records carry substantial weightage in determining credit scores. Timely payments positively impact credit history, showcasing financial responsibility and creditworthiness. Understanding payment records’ impact is crucial for effective credit score management. Conversely, late or missed payments can significantly lower credit scores and subsequently affect creditworthiness. It’s important to note that consistent and timely payments can lead to a positive credit history, thereby increasing credit scores.

Credit Inquiries and Their Effects

Understanding the impact of credit inquiries on credit scores and creditworthiness is crucial for effective financial planning. Multiple credit inquiries within a short period can potentially lower credit scores, making responsible credit inquiry management essential for maintaining good credit scores. Monitoring credit inquiries is a critical practice in sustaining credit score health and overall creditworthiness.

Differentiating Between FICO and Vantage Scores

When comparing FICO and Vantage scores, it’s important to note that both are used by lenders to assess creditworthiness. While FICO scores are widely used and favored by most lenders in the United States, Vantage scores are gaining popularity as well. FICO scores range from 300 to 850, whereas Vantage scores range from 501 to 990. Additionally, FICO considers credit history from all major credit bureaus, while Vantage takes a slightly different approach by considering credit files from the three major credit bureaus. Understanding the nuances between these two scoring models can help individuals make better financial decisions.

Understanding FICO Scores

FICO scores, commonly used by lenders to assess credit risk, are calculated based on credit report information and scoring algorithms. These scores have a significant impact on loan approval and interest rate determination. It is essential to comprehend how they are calculated in order to manage credit scores and plan finances effectively. Keeping track of FICO scores is crucial for staying informed about one’s credit status.

Understanding Vantage Scores

In assessing creditworthiness and financial risk, Vantage scores offer a different viewpoint, utilizing various scoring models and credit report information to provide understanding of an individual’s financial habits. It is important to grasp the calculation of Vantage scores for effective credit score management, as monitoring them is crucial for obtaining a comprehensive understanding of one’s creditworthiness and for making well-informed financial choices.

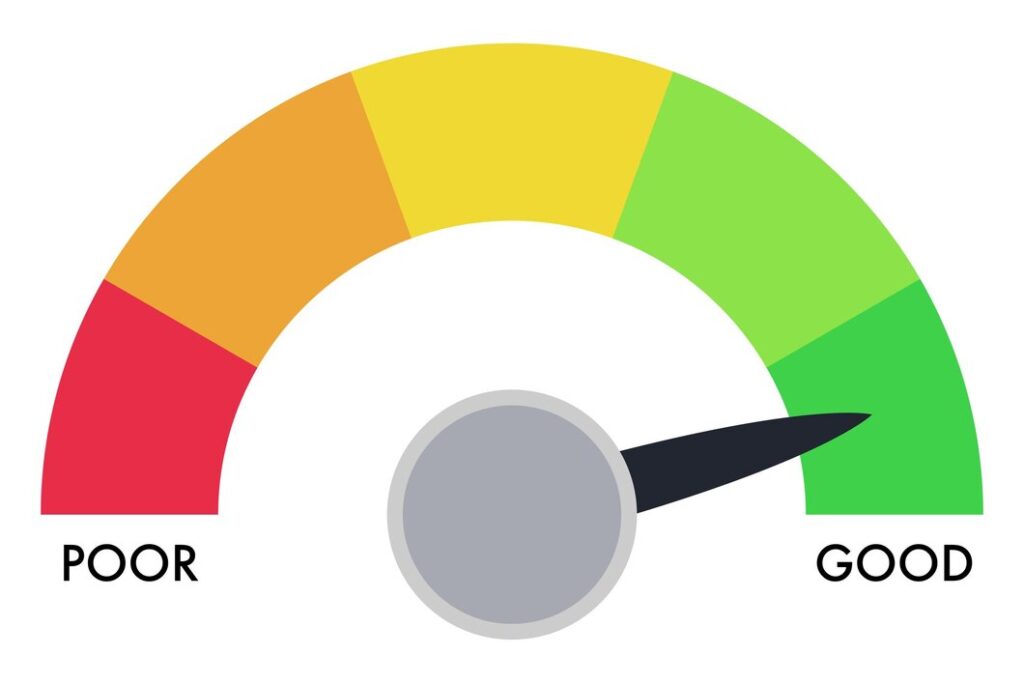

Evaluating Credit Scores

When assessing credit scores. it’s crucial to understand the spectrum, which helps understand good, bad and ugly credit scores.

- Credit scores ranging from 300 to 579 are considered poor.

- Credit scores ranging from 580 to 669 are categorized as fair

- Credit scores between 670 and 739 are classified as good.

- Very good credit scores fall within the range of 740 to 799

- Any score above 800 is considered excellent.

A good credit score opens up opportunities for better terms on loans and lines of credit. However, a bad credit score can limit access to credit or result in higher interest rates.. Understanding these distinctions is essential for maintaining a healthy credit profile.

Steps to Improve a Low Credit Score

Improving a low credit score involves various strategies.

- Firstly, focus on eliminating credit card debt to lower the credit utilization rate.

- Secondly, regularly monitoring your credit report for errors is crucial in maintaining a healthy credit profile.

- Additionally, consider utilizing different types of credit to showcase responsible credit usage.

- Moreover, paying bills on time and keeping a check on hard inquiries can positively impact your credit score.

- Lastly, consider seeking educational resources for improving personal finance and setting financial goals for better credit management.

Eliminating Credit Card Debt

Eliminating credit card debt is crucial for improving financial health and credit scores. By paying off the debt, individuals can reduce credit utilization and positively impact their credit scores. Strategic methods like debt consolidation or balance transfer can help manage and eliminate credit card debt effectively. Developing a realistic repayment plan and budgeting efficiently are key components of this process. Avoiding unnecessary credit card usage and seeking financial guidance can also contribute to a gradual improvement in credit score.

Keeping a Check on Credit Report Errors

Regularly monitoring credit reports is crucial for identifying and rectifying errors, inaccuracies, and potential fraud. Reporting these errors to credit bureaus and lenders maintains accurate credit information. Understanding the factors that influence credit report errors helps in mitigating potential inaccuracies. Addressing these errors contributes to maintaining a healthy credit score and financial credibility. Utilizing available resources and educational materials aids in navigating the process of rectifying credit report errors.

Why Regular Monitoring of Credit Score is Essential

Regularly monitoring your credit score is crucial for early detection of potential errors or fraudulent activities. It enables you to track and improve your credit health while staying informed about any changes to your credit report. By taking timely actions, you can address negative impacts on your credit score effectively. Additionally, regular monitoring provides a deeper understanding of your financial status, allowing you to make informed decisions.

How can Regular Monitoring Help Improve Your Credit Score?

Regular monitoring of your credit score can have a positive impact on your overall credit health. By staying informed, you can address any issues promptly and make better financial decisions. It allows you to track your progress, maintain good payment habits, and work towards building a strong credit history.

Credit monitoring services

/ You can check and monitor your credit score in many ways. Lot of banks and credit card companies are offering free credit score access. Also, there are apps like CreditKarma, CreditSesame etc to check your credit score for free.

Conclusion

In conclusion, understanding credit scores is crucial for managing your financial well-being. A credit score is a numerical representation of your creditworthiness and plays a significant role in determining your eligibility for loans, mortgages, and other financial opportunities. It is essential to maintain a good credit score by responsibly managing your credit history, making timely payments, and keeping your credit utilization low. Regular monitoring of your credit score can help you identify any errors or fraudulent activities and take corrective measures. Improving a low credit score requires discipline, such as paying off debts and avoiding late payments. By following these steps and monitoring your credit score regularly, you can take control of your financial future and achieve your goals.

Image credits:

Image by storyset on Freepik; Image by juicy_fish on Freepik; Image by pch.vector on Freepik