What are some popular budgeting strategies?

Some popular budgeting strategies include the 50/30/20 rule, envelope budgeting, zero-based budgeting, and the cash-only budgeting method. Each strategy has its own benefits and can help individuals effectively manage their finances and increase their savings.

In today’s fast-paced world, managing personal finance effectively is becoming increasingly important. One of the key aspects of financial management is budgeting. Creating and following a budget, using effective budgeting strategies, can help you take control of your spending, save money, and work towards your financial goals. If you’re looking to increase your savings in 2024, this blog will discuss some of the top budgeting methods that can help you achieve that.

Understanding Budgeting

Before we delve into the different budgeting methods, it’s essential to have a clear understanding of what budgeting actually means. Budgeting refers to the process of creating a plan for your money. It involves tracking your income and expenses, allocating funds to various categories, and ensuring that your spending aligns with your financial goals. Budgeting methods can vary, but they all aim to provide structure and guidance to your financial decisions. If you want to learn more about how to get started with budgeting, Refer to our comprehensive budgeting guide from one of our previous articles.

Importance of budgeting for Savings

Budgeting plays a crucial role in building savings, and it is especially important if you want to increase your savings in 2024. Here’s why budgeting is important for savings:

- It allows you to allocate funds to savings accounts: By creating a budget, you can set aside a specific amount of money each month for your savings goals. Whether it’s an emergency fund, a down payment on a house, or retirement savings, budgeting ensures that you consistently contribute towards these goals.

- It helps in building an emergency fund for financial security: Unexpected expenses can arise at any time, and having an emergency fund can provide the financial security you need. A budget helps you allocate funds to an emergency fund, ensuring that you’re prepared for any unexpected financial challenges.

- Budgeting is crucial for debt repayment and retirement savings: If you have student loans, credit card debt, or other financial obligations, budgeting allows you to prioritize debt repayment. By allocating a portion of your income towards debt payments, you can work towards becoming debt-free. Additionally, budgeting ensures that you’re setting aside money for retirement, helping you secure your financial future.

- It ensures a good fit between income and expenses: Creating and following a budget helps you establish a balance between your income and expenses. This ensures that your spending doesn’t exceed your income, reducing the risk of financial stress and living beyond your means.

- It encourages incremental budgeting to increase savings: By consistently reviewing your budget and identifying areas where you can make cuts or increase savings, you can gradually increase the amount of money you save each month. Incremental budgeting allows you to make small changes over time, leading to significant savings in the long run.

How to Start budgeting for 2024?

If you’re ready to start budgeting for 2024 and increase your savings, here are some steps to get you started:

- Start by listing monthly income and expenses: Begin by determining your monthly income from various sources, including your salary, investments, and any side income. Next, list down all your expenses, including fixed expenses like rent, utilities, and subscriptions, as well as variable expenses like groceries, entertainment, and transportation.

- Use budgeting apps or tools for a streamlined approach: Consider using budgeting apps or online tools to help you track your income and expenses, set financial goals, and monitor your progress. These digital tools can simplify the budgeting process and provide you with valuable insights into your spending habits.

- Seek legal advice if there are complex financial matters: If you have legal obligations such as child support, alimony, or any other financial matters that require legal expertise, it’s advisable to seek guidance from a legal professional. They can help you navigate these complexities and ensure that they are factored into your budgeting process.

- Allocate funds for discretionary expenses and savings: After accounting for your fixed expenses, allocate a portion of your income towards discretionary expenses, such as dining out, entertainment, and hobbies. Remember to also allocate a specific amount towards savings, whether it’s for short-term goals like vacation expenses or long-term goals like retirement savings.

- Create a spending plan based on your financial goals: Finally, create a spending plan that aligns with your financial goals. This plan outlines how much money you will allocate to each category of expenses, including savings, debt payments, and discretionary spending. Regularly review and adjust this plan as needed to ensure it reflects your changing financial circumstances.

Popular Budgeting Techniques

Now that you understand the importance of budgeting and how to get started, let’s explore some popular budgeting techniques. These methods can provide structure and guidance to your budgeting process, helping you make the most of your money.

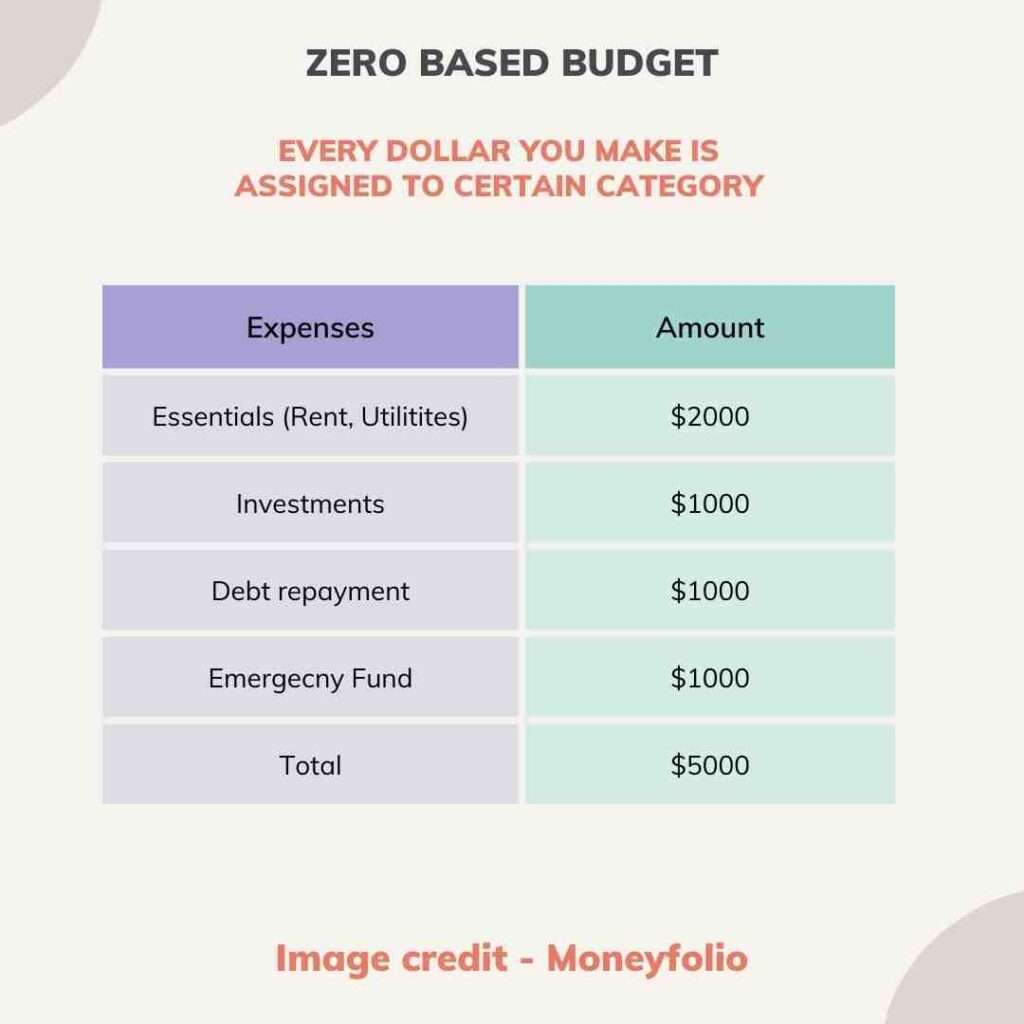

Zero-based budgeting

One popular budgeting method is zero-based budgeting. This approach requires you to allocate all your income to expense categories, ensuring that every dollar has a purpose. With zero-based budgeting, you create a detailed budget for each budgeting period, taking into account all income and monthly expenses and savings. This method encourages incremental budgeting, as you consistently review and adjust your budget based on your financial goals and spending habits. Zero-based budgeting provides a holistic view of your financial priorities, helping you make conscious decisions about where your money should go.

Benefits and drawbacks of zero-based budgeting

Zero-based budgeting offers several benefits and drawbacks to consider:

Benefits:

- Provides a detailed picture of your cash flow and spending habits.

- Helps you prioritize your budget categories according to your financial goals.

- Allows you to review and adjust your budget regularly, ensuring it aligns with your changing financial circumstances.

- Encourages a hands-on approach to money management, promoting financial discipline.

- Gives you a clear understanding of how much money you have available for discretionary expenses and savings.

Drawbacks:

- Requires time and effort to plan and track expenses.

- May be overwhelming for individuals with complex financial situations.

- Requires consistent commitment to the budgeting process.

- May not be suitable for individuals who prefer a more flexible approach to spending and savings.

- Can be more time-consuming initially as you set up and implement the budget.

Envelope System Budgeting

Another popular budgeting technique is the envelope system. This method involves allocating cash to different envelopes representing categories of expenses. Each envelope represents the budgeted amount for a specific category, such as groceries, entertainment, or transportation. When you make a purchase, you use the cash from the corresponding envelope. The envelope system restricts spending to the allocated cash in each envelope, providing a tangible way to control discretionary expenses. This budgeting approach also encourages cash stuffing, where you set aside money in envelopes for future expenses like a vacation or a major purchase.

Benefits and drawbacks of Envelope System Budgeting

If you’re considering the envelope system for budgeting, here are the benefits and drawbacks to be aware of:

Benefits:

- Provides a clear spending plan, separating cash for different categories.

- Encourages budget transparency and control over discretionary expenses.

- Discourages the use of credit cards, minimizing the risk of accumulating debt.

- Offers a tangible way to track spending and gauge budget progress.

- Can be an effective budgeting method for individuals who prefer a cash-based approach.

Drawbacks:

- Requires time to manage cash flow and organize envelopes regularly.

- May not be the best fit for individuals who prefer digital and card-based transactions.

- Can be challenging to implement in today’s increasingly cashless society.

- Requires discipline to stick to the envelope budget and not dip into other categories.

- Doesn’t provide the convenience of budgeting apps or tools that automate budget tracking and categorization.

The 50/30/20 Budgeting Plan

The 50/30/20 budgeting plan is a simple and popular method that divides your net income into three major categories:

- Needs (50%): This category includes essential expenses such as rent/mortgage, utilities, groceries, and transportation.

- Wants (30%): This category covers discretionary expenses, including entertainment, dining out, hobbies, and non-essential purchases.

- Savings (20%): This category focuses on saving money for your financial goals, including emergency funds, retirement savings, debt repayment, and other savings.

- By allocating a specific percentage of your income to each category, the 50/30/20 budgeting plan helps you balance spending and savings goals, ensuring that you’re consistently setting money aside for the future.

Benefits and drawbacks of the 50/30/20 Budgeting Plan

The 50/30/20 budgeting plan offers several benefits and drawbacks to consider:

Benefits:

- Provides a simple budgeting approach, making it accessible for individuals new to budgeting.

- Ensures good control over spending by allocating a specific percentage to essential expenses.

- Balances the need for savings with the flexibility of discretionary expenses.

- Helps in building an emergency fund, retirement savings, and paying off debt.

- Gives you a good idea of your financial habits and spending priorities.

Drawbacks:

- Requires accurate budget categories to ensure proper allocation of funds.

- May not be suitable for individuals with limited income, as fixed expenses may consume a larger portion.

- Doesn’t account for variations in income or expenses month to month, requiring additional adjustments.

- Relies on net income, which may not accurately reflect your financial health.

- Might not address specific financial goals or provide the detailed planning required for some individuals.

Pay-Yourself-First Budgeting

Pay-yourself-first budgeting, also known as the first budget, is a strategy that prioritizes saving money before spending on other expenses. With this approach, you allocate a portion of your income towards savings first, ensuring that you’re building financial security and working towards your goals. This method encourages the habit of paying yourself first, whether it’s saving for retirement, building an emergency fund, or meeting any other savings goals you may have. By making savings a priority, pay-yourself-first budgeting helps you develop financial discipline and reduces the temptation to overspend.

Benefits and drawbacks of Pay-Yourself-First Budgeting

Consider the following benefits and drawbacks of pay-yourself-first budgeting:

Benefits:

- Ensures financial security by setting money aside for emergencies.

- Promotes effective retirement planning and savings.

- Reduces the temptation to spend all your income, leading to long-term financial stability.

- Helps achieve long-term financial goals, such as purchasing a home or funding education.

- Reduces the risk of living paycheck to paycheck by prioritizing savings.

Drawbacks:

- May restrict flexibility in discretionary spending, as savings are prioritized.

- Relies on accurate budgeting to allocate the appropriate amount towards savings.

- Requires discipline and consistency in adhering to the pay-yourself-first approach.

- May require adjustments if income varies significantly month to month.

- Might not be suitable for individuals with high debt payments who need more flexibility in their budget.

The No-Budget Budgeting

For individuals who find detailed budgeting overwhelming, the no-budget budgeting approach offers a simplified alternative. With this method, you focus on spending money only on necessities without assigning specific categories or spending limits. Instead of tracking every expense, the emphasis is on mindful spending habits and making conscious financial choices. The no-budget budgeting approach provides more freedom in financial decision-making, reducing the time spent on budgeting tasks. While it may not provide the same level of financial insight as other budgeting methods, using a debit card with the no-budget budget method is best since it connects directly to your checking account and automatically updates your balance. This way, you can rest assured that you are spending within your means.

Benefits and drawbacks of No-Budget Budgeting

Consider the following benefits and drawbacks of the no-budget budgeting approach:

Benefits:

- Reduces financial stress by simplifying money management.

- Promotes mindful spending habits, encouraging you to prioritize necessities.

- Provides more freedom in financial choices, minimizing the feeling of being restricted.

- Can be an effective approach for individuals with stable income and minimal debt.

- Minimizes the time spent on budgeting and tracking expenses.

Drawbacks:

- May overlook discretionary expenses, leading to overspending in certain areas.

- Relies on your ability to make responsible spending decisions without detailed categories.

- Requires financial discipline to ensure you’re not overspending or neglecting savings.

- May lack an accurate picture of spending trends, making it difficult to identify areas for improvement.

- Might not account for important financial considerations, such as legal obligations, retirement savings, or the need for emergency funds.

Strategies for Successful Budgeting in 2024

Now that we have explored various budgeting methods, let’s discuss some strategies that can help you make the most of your budgeting process in 2024.

Setting Financial Goals

One of the key strategies for successful budgeting is setting financial goals. Whether it’s saving for a vacation, purchasing a home, or planning for retirement, clearly defining your goals is essential. Here’s how to set effective financial goals:

- Determine short-term, mid-term, and long-term financial objectives: Identify goals that you want to achieve in the next few months, the next few years, and further into the future.

- Ensure financial goals are specific, measurable, achievable, relevant, and time-bound (SMART): The SMART approach helps you create goals that are well-defined, measurable, realistic, and time-sensitive.

- Align goals with personal values and priorities: Your financial goals should reflect what’s important to you, whether it’s financial independence, providing for your family, or supporting a cause that you care about.

- Consider both savings and debt repayment goals: Strive for a balance between saving money and paying off debt, ensuring that both aspects of your financial health are addressed.

- Monitor progress towards financial goals regularly: Regularly review your budget and track your progress towards achieving your financial goals. This allows you to make adjustments as needed and stay on track.

Prioritizing Expenses

Another important strategy for successful budgeting is prioritizing expenses. Here are some tips to help you categorize your expenses effectively:

- Distinguish between essential and discretionary expenses: Separate your expenses into two categories—essential expenses, such as housing, utilities, and groceries, and discretionary expenses, such as dining out, entertainment, and shopping.

- Allocate a larger portion of the budget to essential expenses: Prioritize essential expenses first by allocating a significant portion of your budget to cover necessities. This ensures that your basic needs are met before allocating money to discretionary spending.

- Minimize spending on non-essential items to increase savings: Evaluate your discretionary expenses and identify areas where you can cut back. By reducing spending in non-essential categories, you can free up more money to allocate towards savings goals.

- Prioritize debt payments, if applicable: If you have debt, make debt repayment a priority in your budget. Allocate a specific amount each month towards paying down your debt, whether it’s credit card debt, student loans, or other financial obligations.

- Adjust spending based on changing financial circumstances: Flexibility is key when it comes to budgeting. Regularly review your budget and make adjustments as needed, taking into account changes in income, expenses, and financial goals.

Regularly Reviewing and Adjusting the Budget

To ensure the effectiveness of your budget, it’s important to regularly review and adjust it. Here are some tips for reviewing and adjusting your budget:

- Conduct monthly or quarterly reviews of the budget: Set aside time at the end of each month or quarter to review your budget. Look at your income, expenses, savings, and financial goals to assess your progress.

- Make necessary adjustments to the budget based on income and expenses: Compare your actual income and expenses with the budgeted amounts. If there are significant discrepancies, adjust the budget accordingly.

- Consider unexpected expenses while reviewing the budget: Account for any unexpected expenses that may have occurred during the month. This could include car repairs, medical expenses, or any other emergency costs.

- Seek financial advice if the budget needs major alterations: If you find that your budget needs major alterations or if you’re facing financial challenges, consider seeking advice from a financial professional. They can provide guidance and help you make the necessary adjustments to your budget.

- Ensure the budget reflects current financial health and goals: As your financial circumstances and goals may change over time, ensure that your budget accurately reflects your current situation and priorities. Regularly updating your budget will help you stay on track and work towards achieving your financial goals.

Conclusion

In conclusion, budgeting is an essential tool for achieving financial stability and increasing your savings. By understanding the importance of budgeting and implementing popular budgeting techniques such as zero-based budgeting, envelope system budgeting, the 50/30/20 budgeting plan, pay-yourself-first budgeting, or the no-budget budgeting method, you can effectively manage your expenses and maximize your savings in 2024. However, it’s crucial to set clear financial goals, prioritize expenses, and regularly review and adjust your budget to ensure its success. With dedication and discipline, you can take control of your finances and work towards a brighter financial future. Start budgeting today and watch your savings grow!